- Excellion Capital

- End to End Solutions

Loan Structuring & Lender Selection

We look at each transaction on its individual merits, then advise on the most suitable structure and lender.

We provide a full end-to-end service acting as a value added partner to:

- Create competitive tension by bringing about multiple competing term sheets

- Negotiate terms to secure competitive economics

- Instruct valuers, lawyers and Quantitative Surveyors (as required)

- Assist with the review of legal documentation

- Project manage the transaction through to completion and beyond

Where required, we can also assist borrowers with:

- Financial modelling; and

- Corporate structuring.

Some borrowers also rely on us to assist them post deal:

- Covenant compliance

- Ongoing reporting to the lender

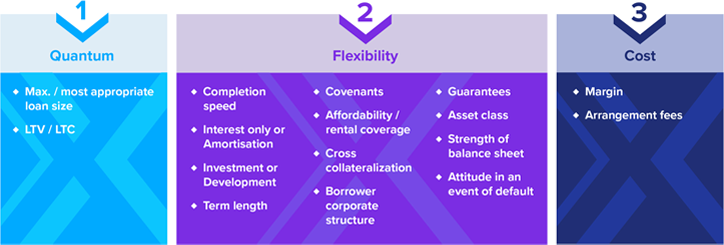

Key Dynamics

In determining the optimal financing structure and identifying the most suitable lenders on a case-by-case basis, we pay due regard to the Key Dynamics, which we classify as follows:

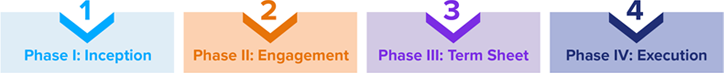

End to End Service

Excellion Capital adds genuine value throughout the debt financing process, assisting, where required, in crafting a suitable corporate and financing structure, and in formulating a sensible business plan – one that supports the financing, and vice versa.

-

Let us help you.

-

Experience, access and attention to detail are essential in this market

-

Submit your enquiry now